If you have a surplus in your limited company, there is a lot you can do with the money. You can reinvest it in the company's operations, make pension contributions, and much more. An interesting option is to invest the surplus in the stock market. As a business owner, you can withdraw the surplus and invest it privately, or invest the surplus directly through the company and then withdraw the money at the end of the investment period. In this post, we will explore the options available to you as a business owner when you want to invest in the stock market, as well as how the development looks between each option. Join us as we explore how you can maximize returns and plan your investment as a business owner.

Investment Options

As a limited company owner, you can choose between withdrawing the surplus and investing privately via, for example, an investment savings account (ISK), or investing the surplus directly in the company via a capital insurance account (KF) and then making a withdrawal. Withdrawals can be made through salary (lön) or dividends (utdelning), so we will go through the following options:

Withdraw the surplus as salary and invest privately in an ISK account

Withdraw the surplus as dividends and invest privately in an ISK account

Invest the surplus through the company in a KF account and after the investment period, withdraw as salary

Invest the surplus through the company in a KF account and after the investment period, withdraw as dividends

Calculation Basis

Salary withdrawal is made under the threshold for state income tax

Dividends are made within the limit for low-taxed dividends

Surplus in the limited company = 100,000 SEK

Investment period = 20 years

Average annual return = 8%

Return tax on Investment Savings Account (ISK) and Capital Insurance (KF) = 1.25%

Withdraw the surplus and invest privately (salary or dividends)

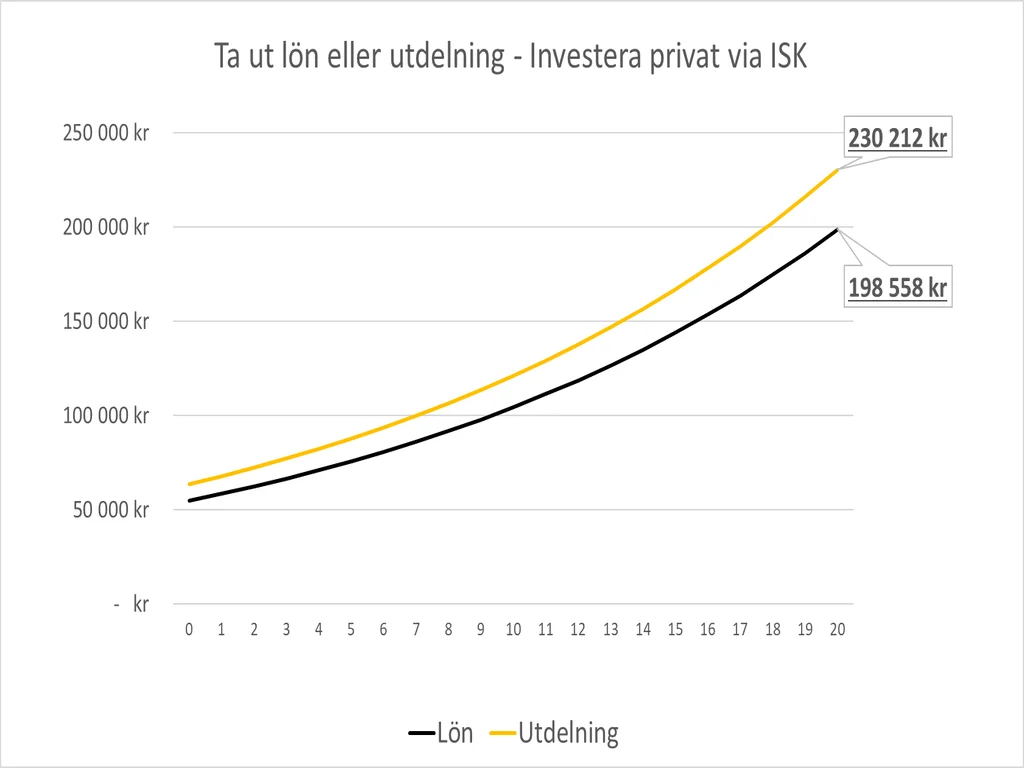

Withdraw the surplus as salary and invest privately in an ISK account

We assume there is a surplus of 100,000 SEK and that you as the owner have not reached the threshold for state income tax. To pay out salary, employer contributions must be paid, and the cost is 31.42% in most cases. To cover employer contributions, a gross salary of 76,062 SEK remains (100000/1.3142).

Then, as an employee, you pay about 30% in tax depending on the municipality, but you get a job tax deduction, so we calculate a salary tax of 28%. After tax is paid, you get 54,786 SEK (76062*(1-0.28)).

54,786 SEK is left, which is then invested privately in an ISK account. After 20 years, with an 8% annual return and a return tax of 1.25%, the total amount after tax is 198,558 SEK.

Withdraw the surplus as dividends and invest privately in an ISK account

As in the previous case, we assume a surplus of 100,000 SEK. Of these 100,000 SEK, 20.6% in corporate tax is deducted, leaving 79,400 SEK (100000*(1-0.206)). Then you pay a 20% tax on the dividends, leaving 63,520 SEK (79400*(1-0.2)).

63,520 SEK is left, which is then invested privately in an ISK account. After 20 years, with an 8% annual return and a return tax of 1.25%, the total amount is 230,212 SEK.

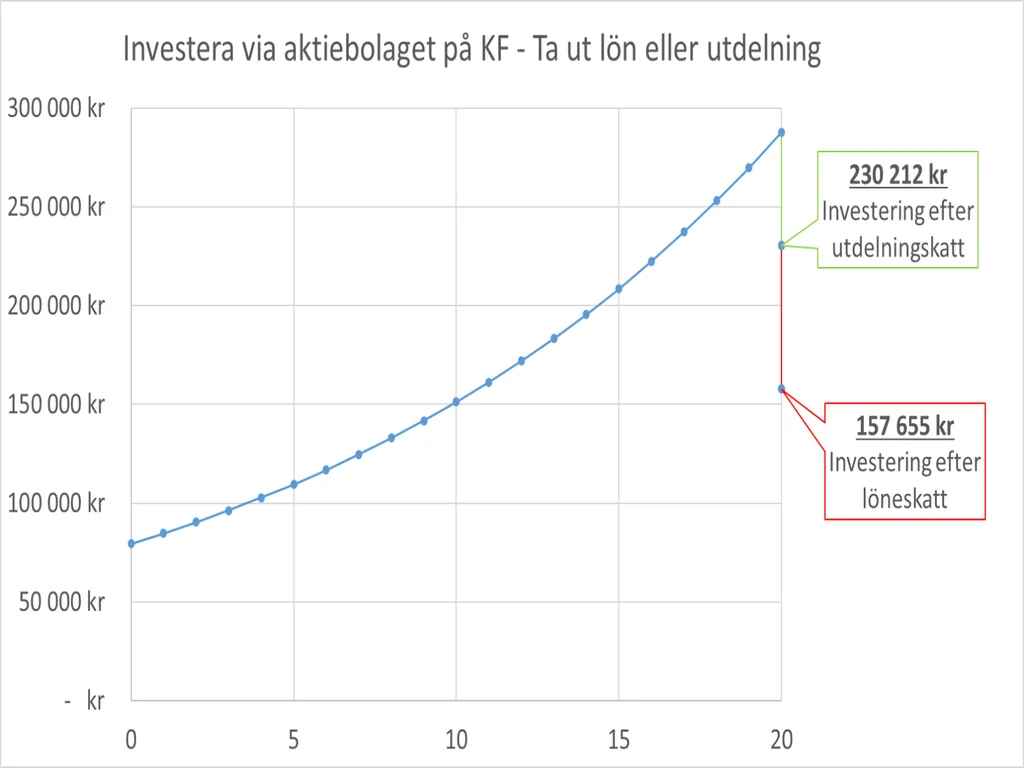

Invest the surplus in the limited company

With a surplus of 100,000 SEK, 20.6% in corporate tax is deducted, leaving 79,400 SEK (100000*(1-0.206)).

79,400 SEK becomes the initial amount invested in the stock market and remains there for 20 years. After 20 years, this capital has grown to approximately 287,765 SEK. To withdraw this capital, either dividend tax or salary tax must be paid, depending on which option is chosen.

Invest the surplus in the company in a KF account and after the investment period withdraw as salary

After 20 years, there is a capital of 287,765 SEK in the company. If a salary withdrawal is made, it must cover employer contributions of 31.42%, so there is an opportunity to withdraw a gross salary of approximately 218,966 SEK (287765/1.3142). We then calculate a tax of 28% as in the first case, resulting in a withdrawal of 157,655 SEK (218966*(1-0.28)).

Invest the surplus in the company in a KF account and after the investment period withdraw as dividends

After 20 years, there is a capital of 287,765 SEK in the company. If a dividend is made, the amount is taxed at 20%, leaving 230,212 SEK (287765*(1-0.2)) after tax.

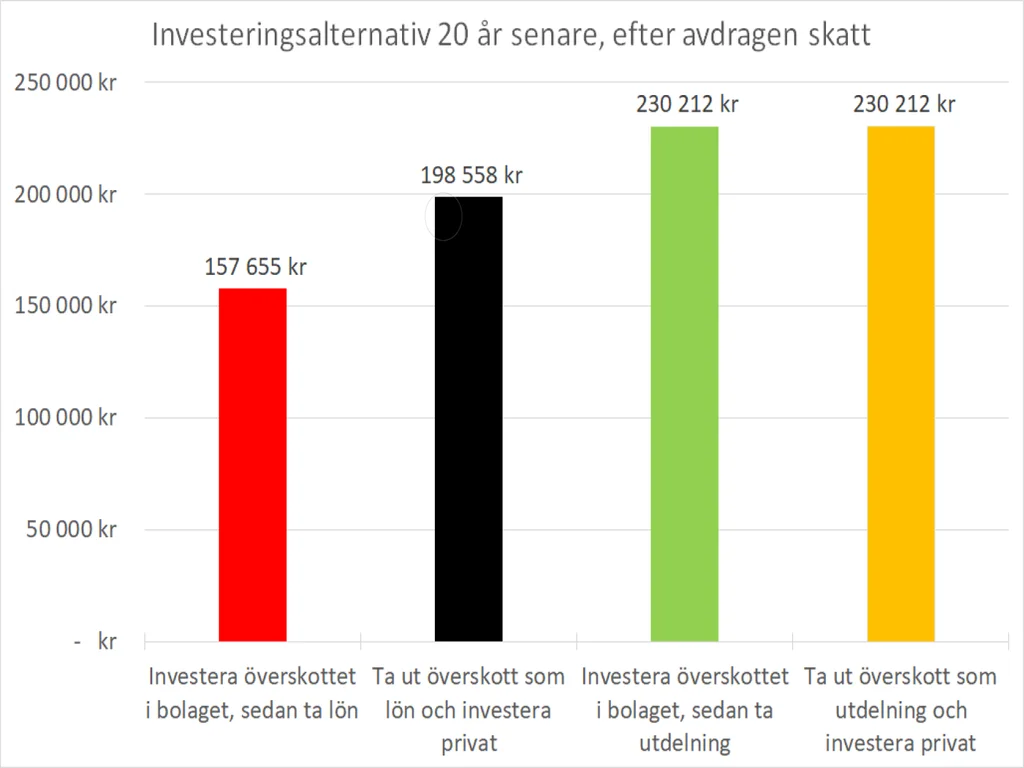

Summary

Before we go through the results, a lot can happen over 20 years. The calculations and summary assume that there are no changes in tax rules or similar. It is also assumed that there is a surplus of 100,000 SEK in the first year and that no other business events affect the company during this period.

As we can see, there can be significant differences depending on the investment option chosen. To maximize capital, it is advantageous to take dividends. It does not matter whether the dividends are taken directly or after 20 years. Next comes the option to withdraw salary in the first year and invest it privately. The worst option is to let the surplus work in the company and then take salary from the worked capital after 20 years.

It is worth noting that salary provides greater security and compensation in case of sick leave or parental leave, and that part of the employer contributions are saved for the pension. There are also some risks associated with having the surplus saved in the limited company.

What suits you best depends on the company's situation and risks, as well as your personal needs and goals. Contact us if you want a customized plan on how to manage the surplus in your limited company.

Contact us if you need help with investments and tax optimization.

Email us

info@digitalbok.se

Call us

010-641 02 93

Adress

Åbroddsvägen 45, 165 70 Stockholm