Accounting firm that manages your bookkeeping digitally

We make it easy for businesses.

Our services

We simplify your financial management. Below you can see our most popular services.

Bookkeeping

We continuously record all business transactions in your company and perform reconciliations. If anything is missing, we will contact you.

Payroll Management

We assist you with employees and ensure that accurate salaries are paid and reported.

Tax Filing

With ongoing accounting, we ensure that VAT and employer declarations are submitted on time to the tax authorities.

Reporting

After each accounting period, we send you a financial report and receipts from submitted declarations.

Year-end Closing

At the end of the fiscal year, we can start the year-end closing process and submit income tax returns.

Consulting

We help you run your business, identifying improvements and optimizing taxes.

Prices for ongoing bookkeeping

Small

795 kr / month

- Revenue up to 1,000,000 SEK

- 20 vouchers / month

- Payroll management for 1 employee

- VAT declaration

- Employer declaration

Medium

1 995 kr / month

- Revenue up to 3,000,000 SEK

- 100 vouchers / month

- Payroll management for 5 employees

- VAT declaration

- Employer declaration

Large

from 2 495 kr / month

- Unlimited revenue

- Unlimited number of vouchers

- Unlimited number of employees

- VAT declaration

- Employer declaration

How the work process looks

1. Documentation

You gather your company's invoices, receipts and other documents every month.

(With digitalization, many documents can be collected automatically)

2. Send

You send the documents via an app that we work with. On the app, you can directly upload files or take pictures.

(With our modern solutions, many of your invoices can be sent to us automatically. We then export payment files to your business bank, saving you a lot of administrative work)

3. We bookkeep

Once the documents are with us, we record all business transactions and ensure that declarations are submitted on time.

4. Communication

If anything is missing, we will contact you via phone or email. If everything is in order, we complete the work and update you with receipts and reports.

5. Save Documentation

By law, documents must be saved for 7 years; this is done in our accounting software.

Are you ready to simplify your business operations?

We understand the challenges of running a business - from ensuring sales and customer satisfaction to managing suppliers, financing, marketing, as well as accounting and administration. Our goal is to simplify your daily business life. Contact us today for a free consultation.

Contact usLatest articles

The requirement to save receipts and paper invoices is now eliminated

From today, July 1 2024, new regulations in the Bookkeeping Act come into effect, allowing companies to store receipts and invoices...

Read More

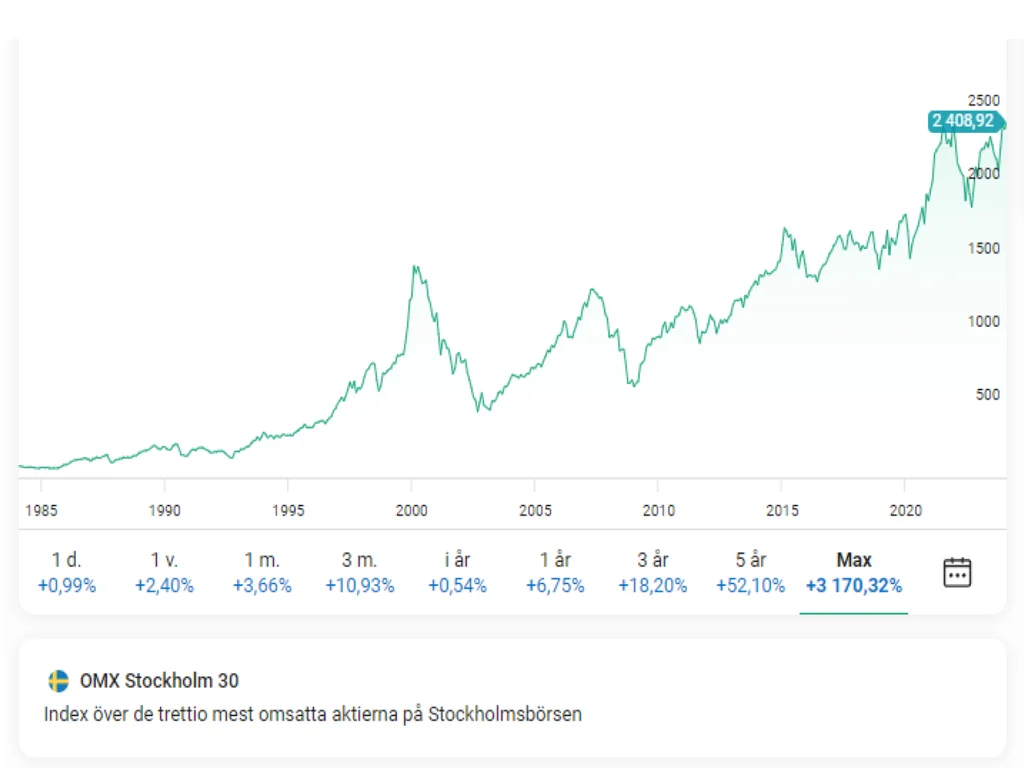

Investing in the stock market: privately or through a limited company?

If you have a surplus in your limited company, there is a lot you can do with the money. You can reinvest it in the company's operations...

Read More

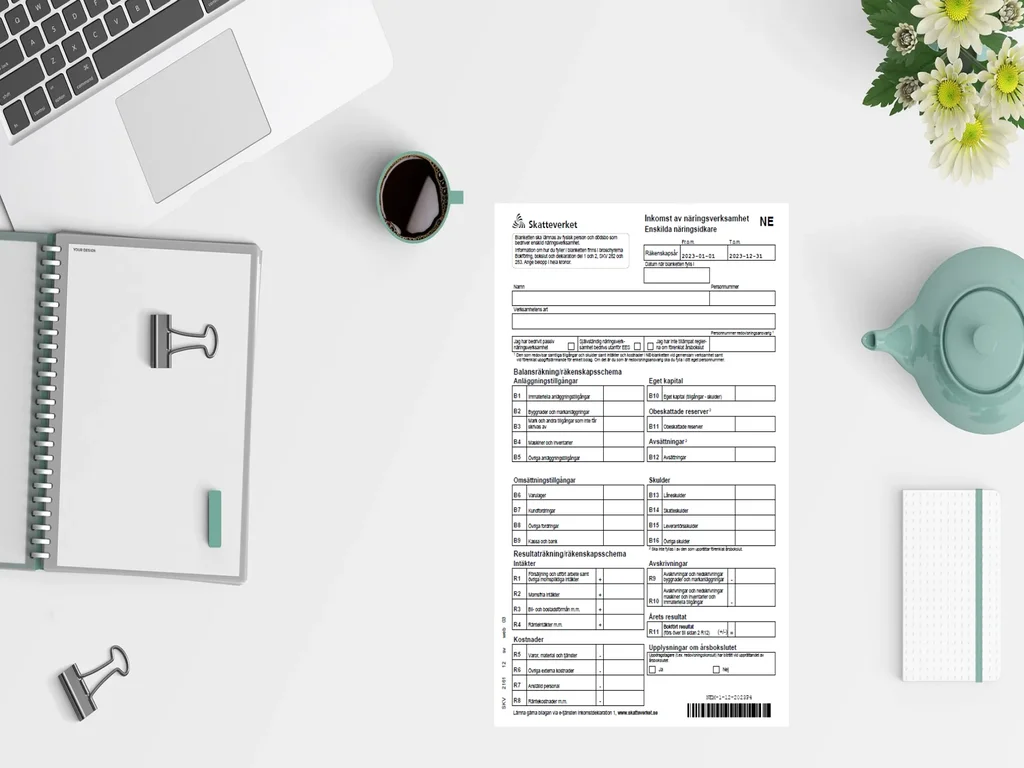

Add NE-appendix to Declaration - Sole Trader

The Swedish Tax Agency's e-service for declarations will open soon. Private individuals and sole traders must submit Income Tax...

Read More

Final accounts - finalize your books correctly

For many business owners, it is time to close the books for 2023, and this is where the final accounts come into play. We will explore...

Read More