The Swedish Tax Agency's e-service for declarations will open soon. Private individuals and sole traders must submit Income Tax Return 1. For sole traders, an NE appendix is required to complete the declaration. We will now go through what the NE appendix is, what information needs to be filled in, and when it should be ready. Follow us through this post to facilitate the declaration process.

What is the NE appendix?

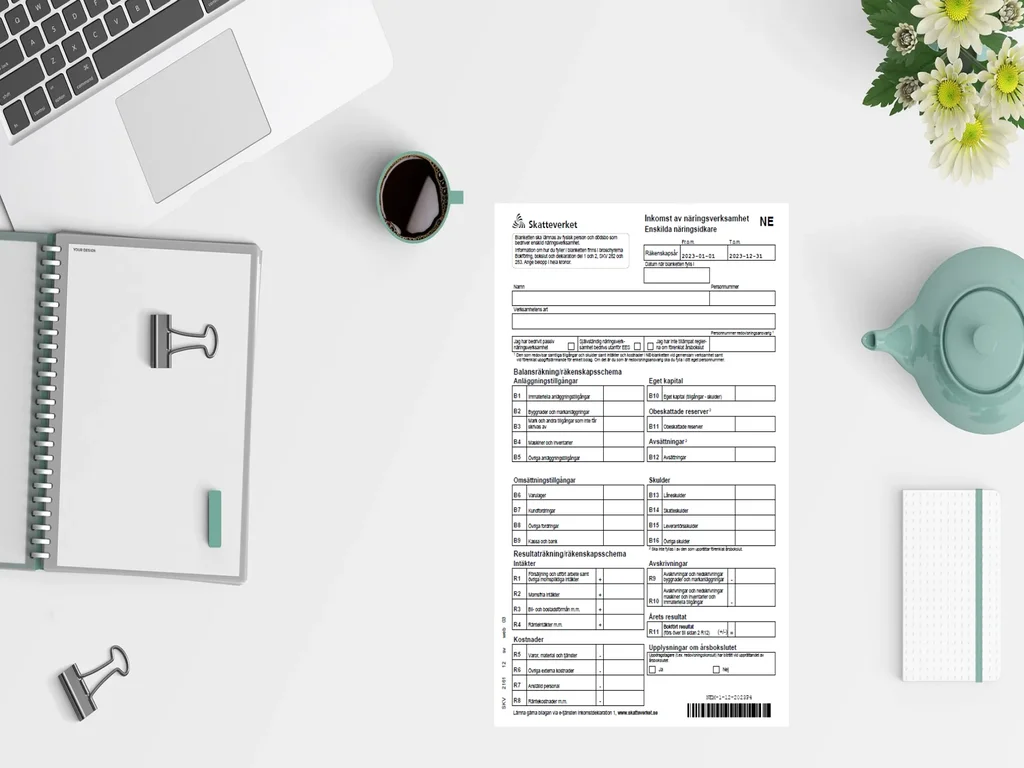

If you run a sole trader business, you must submit Income Tax Return 1 to the Swedish Tax Agency. This is the same declaration that private individuals submit when they have earned income. The difference, however, is the NE appendix, which shows the income from business activities and is added as an appendix together with the income declaration.

What should be filled in the NE appendix?

The NE appendix consists of four parts:

General information

Balance sheet and income statement

Tax adjustments

Other information

General Information

General information in the NE appendix includes personal details, the type of business you have conducted, whether it has been passive business activity, and whether you have used a simplified annual report.

This is where you fill in basic information that provides an overview of your sole trader business for the tax agency.

Balance Sheet and Income Statement

In the balance sheet and income statement section, you report your sole trader's finances based on the annual report. This includes information about assets and liabilities from the balance sheet as well as income and expenses from the income statement.

Tax Adjustments

In the tax adjustments section, you can include tax allocation funds or expansion funds, as well as sickness benefits related to the business, and similar items. After these adjustments are made, you get your taxable income, which is what you will ultimately be taxed on. This result differs from your accounting result because tax adjustments are usually not recorded in the bookkeeping.

Other Information

In the other information section, you can include information about costs for a car used in the business or privately, interest expenses deducted within the business, provisions to the replacement fund, and more. This is the place where you specify details that do not fit within the previous sections but are still relevant to your sole trader business.

When should the NE appendix be ready?

The NE appendix should be completed no later than May 2. It is submitted together with your income declaration to the Swedish Tax Agency. We recommend doing this digitally, but there is an option for those who prefer to submit it physically via a form.

If you need help with the NE appendix and the income declaration, you can contact us using the form below.

Email us

info@digitalbok.se

Call us

010-641 02 93

Adress

Åbroddsvägen 45, 165 70 Stockholm