Corporate taxation occurs after the end of the accounting period. Despite this, businesses must continuously pay preliminary tax throughout the year. Therefore it is important for companies to be able to predict their future finances so that the preliminary tax aligns with the final tax. In this context the preliminary income declaration plays a central role as the basis for calculating the preliminary tax.

What is a Preliminary Income Declaration and why is it important?

The preliminary income declaration serves as a summary of your company's income and deductions for the current year. This information forms the basis for the Swedish Tax Agency's calculation of preliminary tax. If you do not submit a preliminary income declaration, the Tax Agency will use a general standard method based on the previous year's tax data to determine the preliminary tax.

By submitting a preliminary income declaration, you provide the Tax Agency with the proper tools to calculate an accurate preliminary tax that aligns with your actual financial situation and the final tax. Accurate preliminary tax helps you avoid overpayment or unexpected tax debts.

Who should submit a Preliminary Income Declaration?

Those who apply for F-tax, which typically occurs when starting a business. Also those who already have F-tax or FA-tax and anticipate a significant increase in income or change in the fiscal year are required to submit such a declaration. Significant in this context means if the result differs by 30% or at least one price base amount (52,500 SEK in 2023).

When should the Preliminary Income Declaration be submitted?

To allow the Tax Agency to use the declaration as a basis, it should be submitted well before the start of the tax year. This provides time to accurately process the included information and allows for an even distribution of tax payments throughout the year.

If your expected income changes significantly or if the difference between the charged preliminary tax and the final tax is substantial, you should consider submitting a new preliminary income declaration during the year.

How to submit a Preliminary Income Declaration?

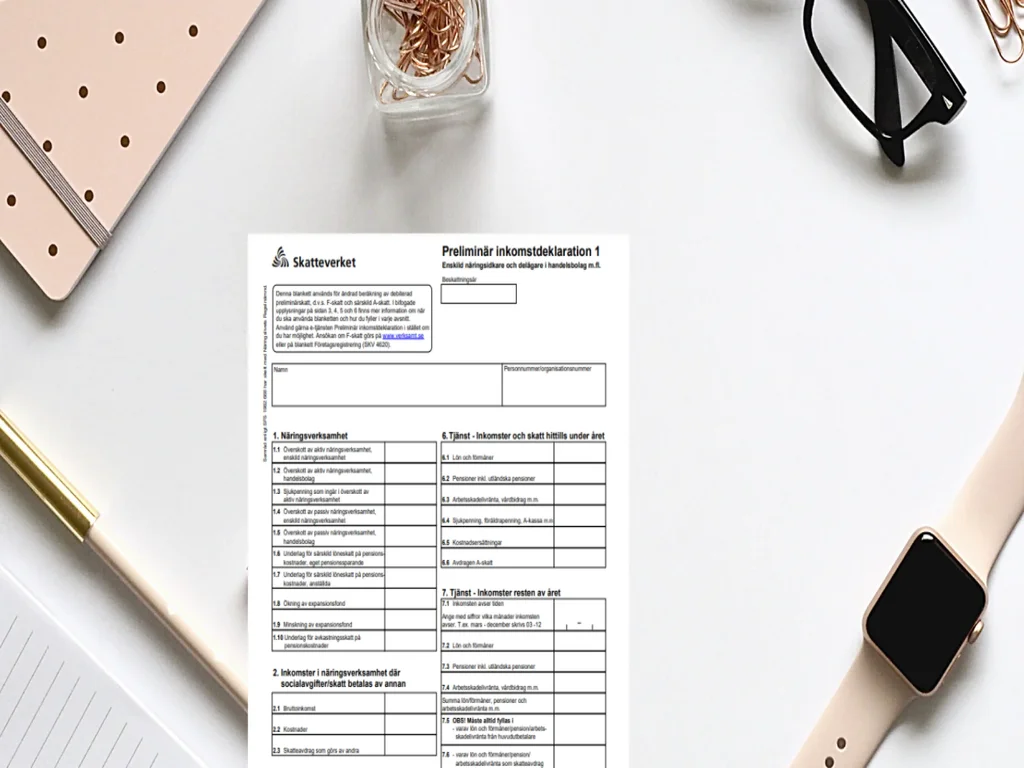

The easiest method is to use the Tax Agency's e-services. Alternatively, you can use the available forms on the Tax Agency's website. For sole traders and partners in partnerships, use the form "Preliminär inkomstdeklaration 1 för fysiska personer" and for limited companies and partnerships, use the form "Preliminär inkomstdeklaration 2 för juridiska personer".

If you need help submitting a preliminary income declaration or have any other questions, contact us using the form below.

Email us

info@digitalbok.se

Call us

010-641 02 93

Adress

Åbroddsvägen 45, 165 70 Stockholm