When you start and register a business with the Swedish Tax Agency, you need to specify SNI codes. We will go through what SNI codes are, how to find the right code for your business and why it is important to use them correctly.

What is an SNI Code?

An SNI code, or Swedish Standard Industrial Classification, is a five-digit code used to describe and categorize companies based on their types of activities. For example, consultants in web development have the SNI code 62.010 and taxi companies have the SNI code 49.320. Statistics Sweden (SCB) uses these codes to collect economic statistics and maintain a register of all Swedish companies.

Which SNI Code should I use?

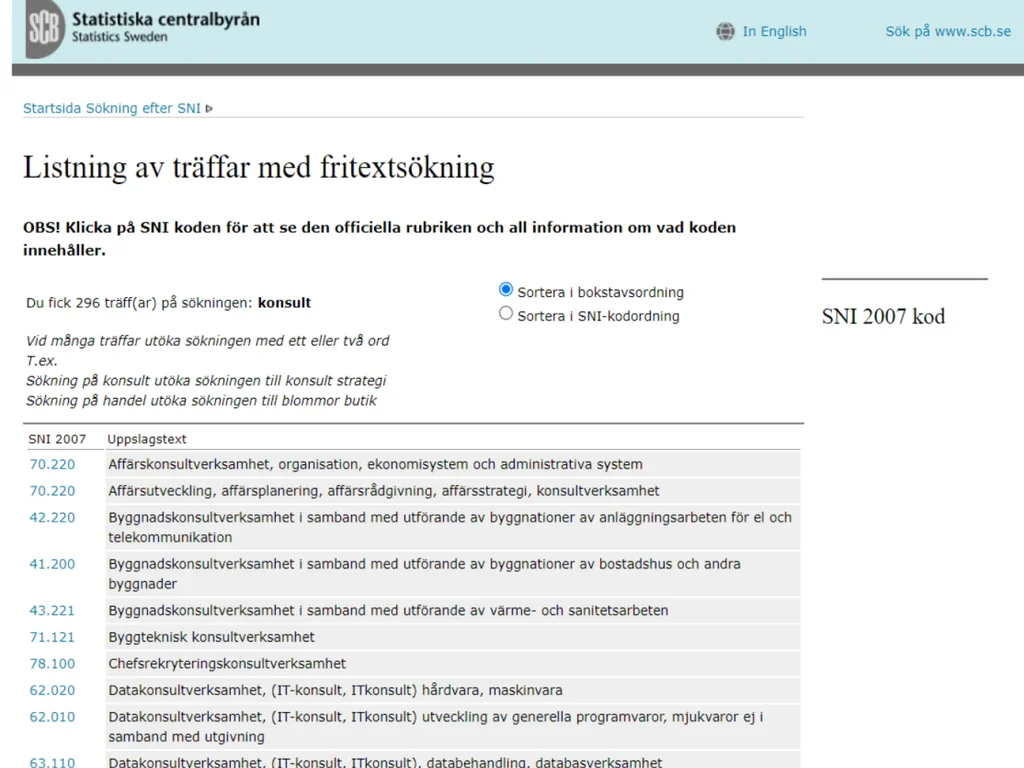

To find the appropriate SNI code for your business, you can use the search service provided by Statistics Sweden at https://sni2007.scb.se. There, you can easily search for your business activity and get suggestions for industries and corresponding SNI codes.

How many SNI Codes can you have?

Companies usually have a primary SNI code that best describes their main activity. However in some cases, a company may operate in several industries and have multiple SNI codes to cover all its activities. If you are unsure, you can always consult with authorities such as the Swedish Tax Agency to ensure you are using the correct SNI code(s) for your business.

Is it important to have the correct SNI Code?

While SNI codes may not play a major role in daily business operations, they are important for the Swedish Tax Agency and other authorities to manage companies correctly. By using the correct SNI code, you ensure that your business is classified accurately and that any benefits or communication from authorities reach your specific industry. If your business activities change, you should also update your SNI code to reflect these changes.

If you need help with your business registration or have any other questions, contact us using the form below.

Email us

info@digitalbok.se

Call us

010-641 02 93

Adress

Åbroddsvägen 45, 165 70 Stockholm